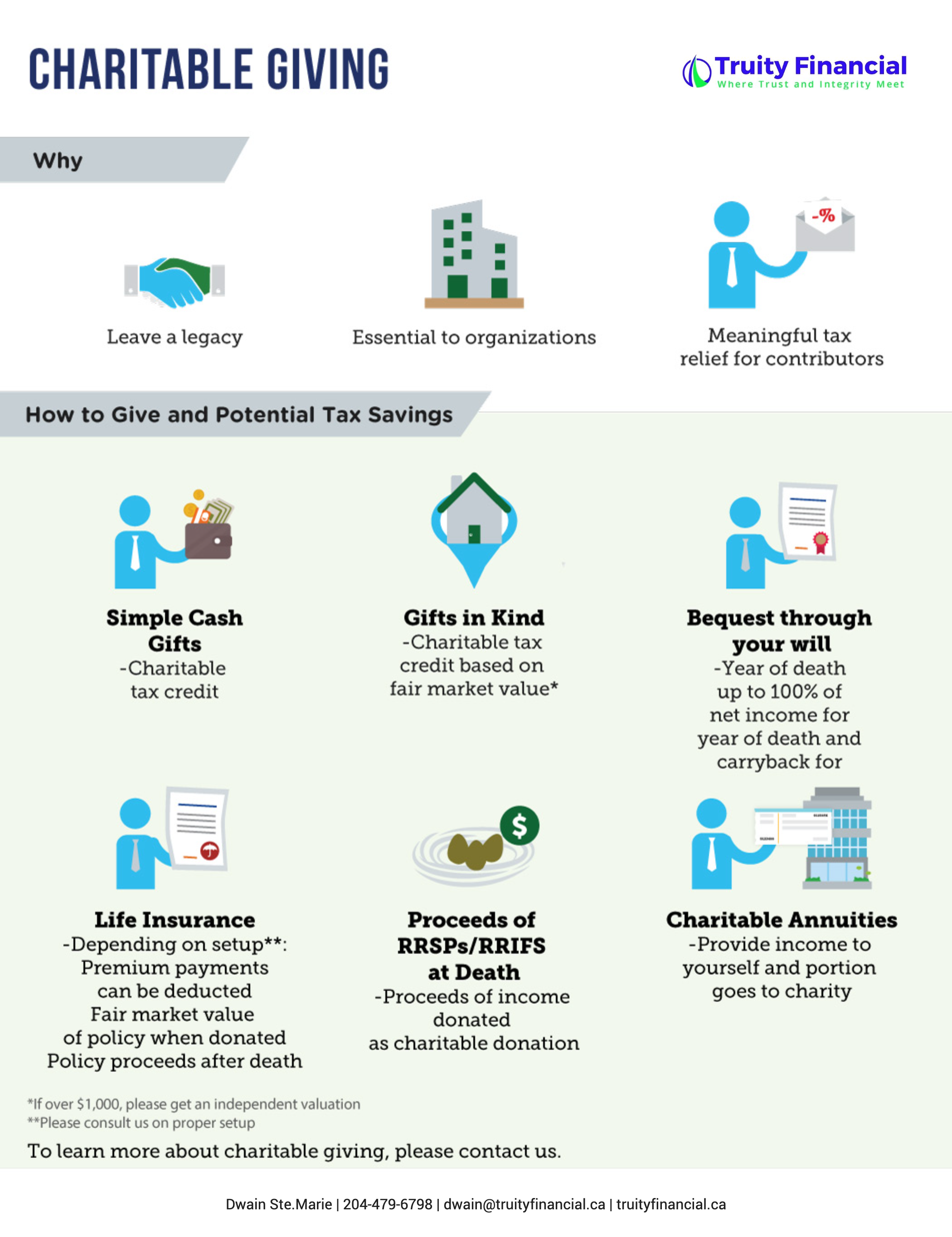

Charitable Giving

Why do individuals give to charity:

● Leave a legacy

● Essential to organizations

● Meaningful tax relief for contributors

There are many ways to give and lots of potential tax savings:

1. Simple Cash Gifts

– Charitable tax credit

2. Gifts in Kind

– Charitable tax credit based on fair market value, if the market value is over $1,000, it’s best to get an independent valuation.

3. Bequest through your will

– Year of death up to 100% of net income for year of death and carryback for year preceding death

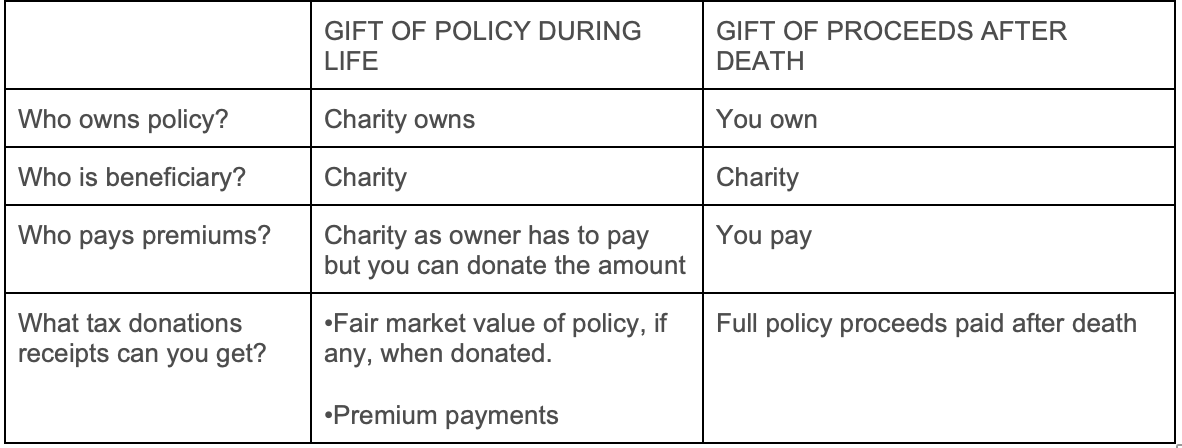

4. Life Insurance

Depending on setup:

5. Proceeds of RRSPs/RRIFS at Death

– Proceeds of income donated as charitable donation

6. Charitable Annuities

– Provide income to yourself and portion goes to charity

To learn more about charitable giving, please contact us.